BMO Smart Advantage™ Checking Account with a $350 welcome bonus

A low-fee, easy-access checking account designed to fit your everyday banking needs.

By: My Next Credit

No Monthly Fees with eStatements

Avoid the $5 monthly maintenance fee simply by opting into paperless statement delivery, making it easy to manage your account with no extra cost.

Access to 40,000+ ATMs

Use over 40,000 fee-free ATMs through the Allpoint® network, giving you convenient access to your money wherever you are in the U.S.

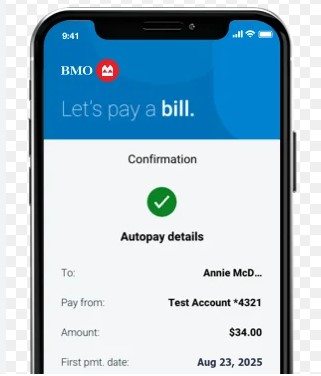

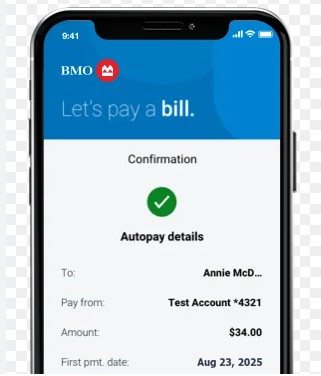

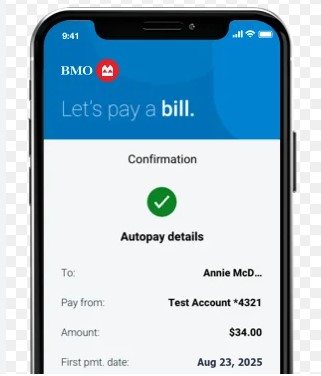

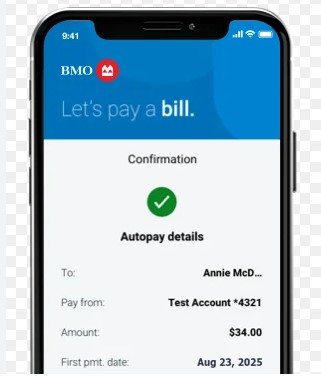

Powerful Mobile Banking Tools

Deposit checks, pay bills, transfer funds, and track spending with the BMO mobile app—offering real-time alerts and insights to help you stay on top of your finances.

Welcome Bonus up to $350

Earn a bonus of up to $350 when you meet qualifying direct deposit requirements after opening your account.

Everything You Need to Know About the BMO Smart Advantage™ Checking Account

The BMO Smart Advantage™ Checking Account is a practical solution for everyday banking with zero monthly maintenance fees when you opt for paperless statements. It’s tailored for individuals who want a reliable, low-cost checking option with convenient digital tools and access to a wide ATM network. One of the main draws of this account is its affordability. You can avoid the $5 monthly maintenance fee entirely just by choosing paperless statements—there are no minimum balance requirements. It’s a hassle-free account that allows you to manage your money without worrying about extra charges. Customers enjoy access to over 40,000 fee-free ATMs nationwide through the Allpoint® network, along with comprehensive digital banking tools. The BMO mobile app lets you deposit checks, pay bills, transfer money, and track spending with ease. Real-time alerts and account insights help keep your finances on track. New customers can also benefit from a generous welcome bonus of up to $350 by meeting direct deposit requirements within a set period of account opening. It’s a strong incentive for those looking to switch banks or open a new account. This checking account is FDIC insured, giving you peace of mind knowing your funds are secure. Plus, if you ever need in-person assistance, BMO offers a solid network of branches across several U.S. states. In short, the BMO Smart Advantage™ Checking Account is a smart choice for individuals seeking low fees, solid mobile tools, and a straightforward banking experience backed by a well-established financial institution.

-

What is the minimum opening deposit for the BMO Smart Advantage™ Checking Account?

The minimum opening deposit is $25.

-

How can I avoid the monthly maintenance fee?

You can avoid the $5 fee by enrolling in paperless (eStatement) delivery.

-

Does the account offer a sign-up bonus?

Yes, new customers can earn up to $350 by meeting qualifying direct deposit requirements.

-

Can I open the account online?

Yes, the entire application process can be completed online in just a few minutes.

-

Is this account available nationwide?

While the account is accessible online, in-branch services are limited to states where BMO operates.

How to Apply for the BMO Smart Advantage™ Checking Account

Opening a BMO Smart Advantage™ Checking Account is simple and can be completed entirely online or at a nearby BMO branch. Whether you're a new or existing customer, the process is quick and designed to be user-friendly. To get started, visit the BMO Smart Advantage™ Checking Account page and click “Open Account.” You’ll be guided through a step-by-step process that includes entering your personal information, verifying your identity, and funding your account. A minimum opening deposit of $25 is required. BMO will also ask you to select whether you prefer eStatements or paper statements. Choosing eStatements allows you to avoid the $5 monthly maintenance fee. Make sure you also provide your Social Security number and a valid form of ID. If you’re eligible for the promotional offer, be sure to set up qualifying direct deposits within 90 days of account opening to receive the bonus. You can track your bonus progress through your online banking dashboard. Once your application is approved and your account is funded, you’ll receive a BMO debit Mastercard® by mail. You can immediately begin using your digital banking features through the BMO mobile app, which supports check deposits, transfers, and more. BMO’s customer service team is available by phone or at local branches if you need help during or after the application process. For those preferring face-to-face interaction, in-branch account setup is also available. With no complicated requirements, applying for a BMO Smart Advantage™ Checking Account is an accessible way to gain a reliable financial partner.